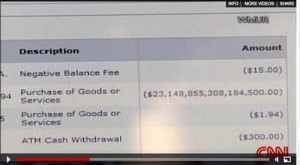

Overdraft bank fees are frustrating, annoying and can make you feel like you’ve been robbed. In one incident, a New Hampshire man, Josh Muszynski bought a pack of cigarettes from a local gas station. Later that day, he logged on to his bank account and was shocked to see a 23 quadrillion dollar overdraft ($23,148,855,308,184,500)! Josh thought that his account had been comprised and that someone had bought Europe with his card! He didn’t know what could cause that to happen. The bank, unable to account for the error, fortunately reversed the huge charge within 24 hours.

During 2009, abusive overdraft and insufficient-funds fees brought banks more than $38 billion dollars. The new credit card regulations have been helping to bring that number down. The new law protects consumers from abusive fees, penalties, interest rate increases.

With statements sent out in March of 2010, you might see additional information printed on your credit card statements. The new credit card statements include an easy to see LATE PAYMENT WARNING which tells you what your late fee is going to be if you don’t make a payment by the date printed. This is easy to see and is not buried in fine print on the back of your statement.

Then you’ll see the sobering statistics that will come to reality if you continue making the minimum payments. If you continue on your merry way, it may take you 20 years, 25 years or 30 years to get rid of this debt.

Followed by that horrifying news, it tells you how long it would take you to pay off your debt if you just made a larger payment every month.

Then you are asked if you would like an aspirin or a drink. Not really, but it does offer you credit counseling services and gives you a number to call besides 1-800-IAM-DUMB.

In early March, 2010, Bank of America came to our financial rescue by deciding to help us avoid overdraft fees. Now they are actually going to decline your debit transaction at the point of sale if there are insufficient funds, instead of letting it go through and charging you fees.

Although there are new protections for consumers to avoid overdraft fees, you can still be charged fees if you are late on your payments. Do yourself a favor and keep your payments current if you have any credit card debt.

The best way for you to manage your money is to buy things that you can pay for with the money you have. Sounds pretty simple. Why has credit card debt quadrupled between 1992 and 2008 to $853 billion dollars? – Because many don’t follow this advice.

Joshua Kennon, a person who saved 90% of his income for a very long time, reminds us that “there are tens of millions of Americans who live free from the burden of credit card debt and there is absolutely no reason you can’t be one of them. ”

If you have suffered from overdraft fees and it has negatively affected your finances, you will most likely be very happy that the credit card rules and regulations will help you end this destructive force.