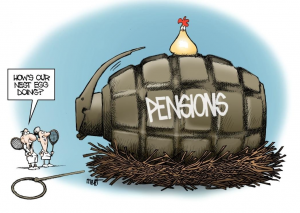

Now imagine that the cushion has disappeared. Your employer regrets to inform you that there has been a mistake and the amount of your pension is being drastically cut. It has happened frequently enough lately that it isn’t possible to ignore.

For instance, one Hawaiian man was informed by his former employer that he had been overpaid by $97,000 over a period of twenty years. The company wanted $66,000 back, please. The 65-year-old found his pension reduced from $1,300 per month to $800.

Changes in pension policy

The example is not without precedent. Huge changes in pension policy have left thousands of retirees blindsided and wondering what to do next, according to an AARP magazine article. Bankrupt cities such as Detroit are targeting pension plans in an effort to stay afloat. Private companies are selling off obligations in the form of annuities, freezing or under funding their pension plans or shifting their employees to 401(k)s, Traditional pension plans now go to only 16 percent of the country’s workers. That’s about half of the 35 percent in the early 1900s who put their faith in pensions to finance their retirement.

Recent federal legislation that allows some financially beset companies to cut benefits to former employees under age 80 has exacerbated the situation. A growing number of retirees find themselves with less to live on as their pensions are trimmed.

Some financial experts predict the demise of the traditional pension program in the United States. The congressional edict shifts the burden from the employers to those least able to afford it – retirees or their surviving spouses, according to the Pension Rights Center, which fought the legislation.

Multi-employer plans, which were created to provide a pool for pension plans for companies, primarily those dealing with unionized workers, are feeling the changes. Reduced union membership and market declines have created problems for at least 150 to 200 of those plans. Some are expected to run out of money within 20 years. A complex process for modifying benefits will protect workers for some time, but cuts are likely over time.

The legislation could leave millions of Americans with their retirement plans in shambles. The Hawaiian resident, who worked as a sheet metal worker in Chicago, found himself the unwitting victim of his company’s sloppy handling of its pension program. Over a thirty-year period, the company overpaid retirees (he was one of 588 affected) more than $5.2 million. Even a decade after the whopping error was discovered, steps hadn’t been taken to rectify the problem, hence the shock of learning that he was expected to help repay the over payments, with 7.25 percent interest tacked on.

An even more painful cut occurred when a South Carolina retiree’s monthly pension check dropped from $1,414 to just $5. His former employer’s reasoning: it had overpaid him by more than $263,000. They argued that disability payments the man had received should have offset much of the retirement payment. As an employee of the New York transit system, he had suffered serious injuries, including a bullet in the head and stab wounds in the chest, in encounters with thugs while working.

How retirees can protect themselves

These examples are not the only ones being reported in the country. In both the private and public sectors, pension problems are manifold. Attempting to recoup disputed pensions is now one of the leading tasks of some legal agencies. Local laws related to pension errors are not consistent, so recovery is unpredictable.

Retirees are advised to protect themselves by asking to see the calculations that figured the amount of their pension. If you are unclear on your situation or feel you need help in understanding your rights, contact the Labor Department at dol.gov or call, toll-free, 866-444-3272, If you are still working, file relevant materials such as W-2 forms and pay stubs. Also keep documents related to pension plans, including a plan description, benefit statements and notices you are sent.