A recently announced (Oct. 24, 2011) new federal refinance program may offer a solution for as many as 1 million distressed home owners. Changes to the Home Affordable Refinance Program (HARP) were made in an effort to attract more eligible borrowers who can benefit from refinancing their home mortgage. The new, more lenient requirements will be available to homeowners who are current on their payments, regardless of how much their property values have dropped. Those who have failed to maintain a good payment record will not be eligible.

Eligibility Requirements

- The mortgage must be owned or guaranteed by Freddie Mac or Fannie Mae.

- The mortgage must have been sold to Fannie Mae or Freddie Mac on or before May 31, 2009.

- The mortgage cannot have been refinanced under HARP previously unless it is a Fannie Mae loan that was refinanced under HARP from March-May, 2009.

- The current loan-to-value (LTV) ratio must be greater than 80%.

- The borrower must be current on the mortgage at the time of the refinance, with no late payment in the past six months and no more than one late payment in the past 12 months.

Being “underwater” keeps millions of Americans from benefiting from record-low mortgage interest rates. The term refers to homeowners who owe more than their homes are worth, often because of falling values that are beyond their control. One in four homeowners with a mortgage falls into the “underwater” category. That’s more than 11 million people and their frustrations add to the current drag on the housing market in particular and the broader economy in general.

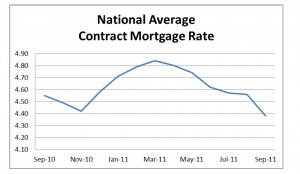

On average, underwater mortgage payers are stuck with a 5.7 percent rate on a 30-year fixed mortgage, according to CoreLogic and the Associated Press. A drop to today’s average rate of 4.11 percent on the same mortgage would save the purchaser of a $250,000 home more than $200 per month. That could put tens of billions of dollars into consumer spending, economists say, a worthwhile kick for the lagging economy.

For many Americans, a few hundred dollars per month is the difference between paying their mortgages and walking away from the property.

The new government plan, with full details still to be announced, would reduce refinancing fees and provide guarantees calculated to put lenders more at ease when issuing loans. It would encourage shorter-term mortgages and apply to borrowers who are only slightly above water.

While by no means the sole answer to the nation’s economic woes, this partial relief for many underwater homeowners is a positive step in the right direction.