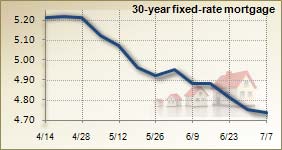

Mortgage rates have fallen again to a near record low. You would think that people would be rushing out to refinance their mortgages and to some extent they have been. Applications for refinancing grew by 9.2 percent last week.

The dilemma is that people who would benefit by these lower rates are not the ones that are getting the new loans. With record unemployment rates, people have gotten into the situation where they now don’t qualify for these loans. Even if they have managed somehow to keep current on all payments due to lenders and credit card companies, their employment history knocks them out of the game.

If you have changed professions, which many people have been forced to do, you need a two year record of proven income to be considered for refinancing. Even with record-low mortgage rates, there just aren’t a lot of qualified borrowers.

In California, one homeowner has not made a mortgage payment for seven months and has not been subject to foreclosure yet. “We have 19 million vacant housing units in the United States, and I’m afraid it’s going to put some more of them on the market,” says Ted C. Jones, chief economist for Houston-based Stewart Title.

Financial analysts predict that mortgage rates will rise soon over the next week. Mostly because they feel it really can’t go much lower.