Managing money is a lifetime skill that is learned from someone, whether it is a family member or through reading and educating yourself about it. What is interesting is that your sense of self worth actually can empower you to be better at managing your money and saving money.

According to financial expert, Suze Orman, you alone are the power behind your money management skill. You make the choices to spend, save or borrow money. What is going on in your mind is what is controlling your financial security.

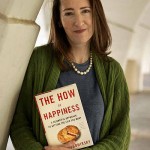

Sonja Lyubomirsky, Ph.D, wrote a book called The How of Happiness. She highlights five steps to happiness which can also apply to developing better money management skills.

Step 1 – Cultivate optimism – When you choose to believe in a future that is positive for yourself and your loved ones, you create pictures in your mind about how you want your life and your finances to be. Optimism helps anyone get through the day. Suffering from negative thoughts is just that. You are suffering. Try everything you can think of to bring back optimism into your life.

Step 2 – Invest In Social Connections – In your personal life, do something for someone else and continue doing random acts of kindness. In your financial life, when you make good connections with people by getting to know them and serving them, your sense of well being will improve and who knows, maybe you’ll get a referral to just the job you were dreaming about.

Step 3 – Let Go Of The Negative – If you are flooded with negative thoughts, write them down and develop some solutions to fix the problems. If you can’t stop thinking of them ask yourself, “What negative thought can I let go to make room for more happiness, more financial security, more abundance? Letting go or coming to peace with yourself that you have done everything you can to solve the problems, will bring relief and contentment. You may even come up with new ways to attack the problems you have.

Step 4 – Finding Meaning In Adversity – Everyone has gone through adversity in their lives whether it is in relationships or in their financial lives. What exactly have these experiences taught you? Have you learned from your failures? Gaining the strength to become debt free will teach you what you need to do to stay that way and give you a sense of control over your financial future.

Step 5 – Learning To Let Go – Past hurts, past mistakes, past failures are well, in the past. Over time you are better off letting go of these pains and forgiving yourself or others for their part in your personal or financial pain. Letting go of these means you have forgiven and when you forgive, your soul returns to the loving state it began with. Letting hatred and bitterness take over your life will not leave you room to grow and learn new things.

In conclusion, these five steps can help you achieve peace in your financial life and peace in your personal life. The power to control your future depends on your attitude and desire to reach your goals. As Suze Orman often says, “Self-Worth builds NET WORTH.”