What are hedge funds?

If you have ever wondered about what hedge funds are and why their managers seem to be in the news and occasionally headed to jail, you will find a simple explanation here. Written especially for our Coolchecks.net consumers, we hope this helps you gain a better understanding of hedge funds.

Hedge funds are private entities that collect monetary funds from more than one source (individuals or groups) and then invest those funds into diverse financial portfolios. Hedge funds are designed as an investment vehicle that is structured as a company or partnership. The average person will not be able to invest in this type of investment vehicle. Find out why below.

History

The creation of hedge funds began somewhere in the 1920’s. Today, the global hedge fund industry has net assets of $2.13 trillion (reported in April of 2012). Many of them are created in offshore financial centers to avoid adverse tax consequences. The Cayman Islands has 34% of the world’s hedge funds.

Only wealthy investors are allowed to invest and are screened closely by the SEC. Most often institutions (61%), foundations, universities or people with exceptional wealth are allowed to invest in hedge funds. Some funds have a net asset value in the billions.

Hedge funds can also be compared to mutual funds but with a slight difference. Mutual funds call for investments from various sources but within the same financial portfolio. Conversely, if you are fortunate enough to be able to invest with hedge funds there are many choices for investors where they can choose any financial portfolio; invest for long term as well as short term; leverage their financial standing; trade in simple to complex stock derivatives; and invest in side pockets ( a type of hedge fund).

Hedge Fund Managers

The managers of hedge funds derive income by the means of a performance-fee and a management-fee. While the management-fee falls within the range of 1 percent to 4 percent of yearly invested funds, the performance-fee falls within the range of 10 percent to 50 percent of yearly return of the invested funds. Steadfast regulation is followed in the case of performance-fund where these charges are collected solely on the net profits after deduction of last year’s losses. Top Hedge fund managers earn enormous sums of money per year. Some reach the $4 billion mark. For the top 25 hedge fund managers, the average salary in 2011 was $576 million.

Investment Configuration

The basic structure of hedge funds is configured in limited partnerships where the fund manager acts like a general partner and every investor is akin to limited partners. Administrators and subordinate analysts work under the manager and take care of the operational funds and analyze the selections of the investment portfolio. More people can also be used to find prospective investors.

Investment Directive

There are comparatively simpler and lesser directives involved in hedge funds because they have such stringent prerequisites. Due to this reason, the rules and regulations are lenient and moderate. However, the participating investors are supposed to abide to rules laid by the SEC and its associated acts. One prominent regulation concerns the funds’ marketing. The SEC disallows explicit advertising in order to seek investors. This regulation also demands complete scrutiny of its comprehensive marketing materials.

World’s Most Successful Hedge Funds

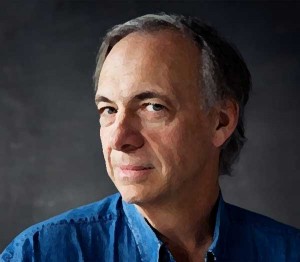

The world’s most successful hedge fund manager is Ray Dalio (born 1949) who owns and manages the Hedge Fund firm, Bridgewater Associates, the world’s most successful hedge fund firm. Dalio is often referred to as the Steve Jobs of investing. He began his career at the age of 12, investing $300 in Northeast Airlines which later merged with another company and tripled his investment. Currently, he is advising people to look at what is happening in the world around you and try to stay one step ahead of it.