The deadline has passed, but as of a few weeks ago, fewer than half of America’s credit and debit cardholders had received a new card containing the chip that is supposed to help combat card fraud, according to Cardbeat research.

And of those whose card issuer has presented them a card with the new technology, many have never actually use it as intended, the research showed. The survey was conducted by Auriemma Consulting Group, who surveyed some 400 adult cardholders to gather the data.

The chips, which are being pushed by Europapy, MasterCard and Visa (EMV), showed that at the time of the survey (in June) about 47 percent of the respondents had at least one chip credit card and about 25 percent had a debit card containing the chip.

Add to this problem the dearth of merchants who have the new equipment required to read the enhanced cards and you have a very slow start to a process that was ballyhooed as a major step toward thwarting fraud in stores. A USA Today report said that a mere 27 percent of all the merchants who are expected to use the technology had acquired the equipment to put it into practice. Small businessmen, in particular, have complained at the cost of readers, although some models sell for about $100. For large retailers, of course, the cost escalates, but they have the capacity to pay more.

The effort took on more steam during September as an Oct. 1 deadline approached that shifts the liability for fraud to the seller instead of the institution that issued the card.

Those consumers who are using their new chipped cards complain that the technology increases checkout time at the store. Those who issue the cards say that a certain amount of experience is necessary to make the changes in habit that will ensure the program’s success. Until more merchants have the equipment to read the new cards, that experience will be spotty, they say.

In the meanwhile, as the transition moves ahead, merchants say their new readers will continue to process the magnetic strip cards that are in current use.

Most people who get a new card (67 percent in the Auriemma survey) are aware that the blossoming technology will make it harder for unauthorized users to counterfeit a chip card than one with a magnetic strip. Huge breaches of card security in some of the country’s major companies in the past few years provided much of the impetus for new technology.

Internal mistakes will remain a problem, according to an Experian publication. Training for clerks who are in charge of customer transactions is another component in the whole move to chip technology. And the curve for customer education must be speeded up to make it work. Many customers still prefer to swipe their card rather than hand it over to be read by a chip reader, even though the magnetic stripe reading is more vulnerable. The reluctance on the part of customers may be more understandable in view of reports that 35 percent of them using a chipped card have difficultly in making their transaction. The process takes longer, they complain, and many are not aware that the card has to stay in the reader until the transaction is complete. If they remove it prematurely, they have to start the process over again.

The upcoming Christmas shopping season is likely to be the true trial of the chip card technology. Education on all sides of the issue is the answer, but if the ultimate outcome of the switch is a decrease in the multi-billion dollar fraud that occurs at the checkout line, the problems associated with the transition will all be worthwhile.

Many Americans like to make big-item purchases – cars, for instance – part of the excitement of the holidays. There’s something about a big red bow atop a new vehicle that makes the purchase memorable.

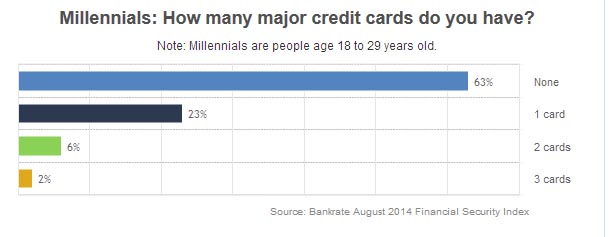

Many Americans like to make big-item purchases – cars, for instance – part of the excitement of the holidays. There’s something about a big red bow atop a new vehicle that makes the purchase memorable. Who would ever guess that being without credit cards could be a problem? Too many people know the stress of having to make the payments that credit cards require, but not having any cards can create difficulties of another kind. Borrowing in the future may be hampered if you haven’t built a history of bill-paying.

Who would ever guess that being without credit cards could be a problem? Too many people know the stress of having to make the payments that credit cards require, but not having any cards can create difficulties of another kind. Borrowing in the future may be hampered if you haven’t built a history of bill-paying.